This page describes each feature of the LE or Loan Estimate and shows you the location on the document. Click on the tabs below for a brief description of each feature. Although you may not have an LE (Loan Estimate), you can use any document that outlines the terms of your loan. If you do not have an LE, you may use a Fee Worksheet or any disclosure.

How much will my payments be for this mortgage?

Your estimated monthly mortgage payment is listed under the "Projected Payments" section on Page 1 of the Loan Estimate.

This section divides the mortgage payment into 3 parts:

- Principal and interest. This is the portion of the payment that goes to the bank to pay off the amount you borrowed, plus interest.

- Mortgage insurance. If you borrow more than 80% of the home's value, the lender will require you to pay mortgage insurance. This is how much mortgage insurance will cost per month.

- Estimated escrow. This is an estimate of the monthly cost of your property taxes and homeowners insurance.

This page will explain all the aspects of a Loan Estimate or LE. Simply click on each tab for a brief explanation of each of the feature of the LE.

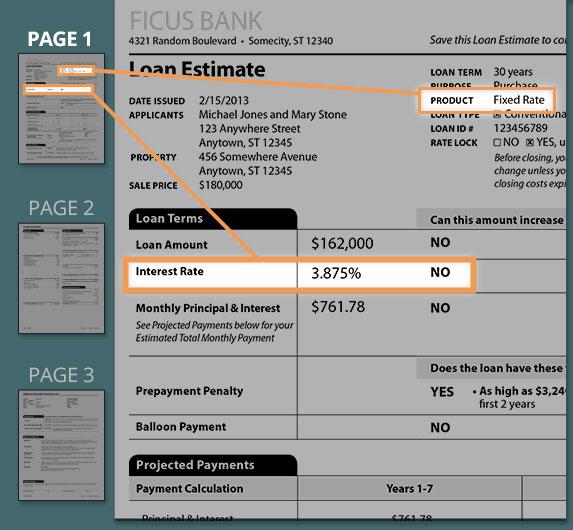

What's the interest rate on the mortgage?

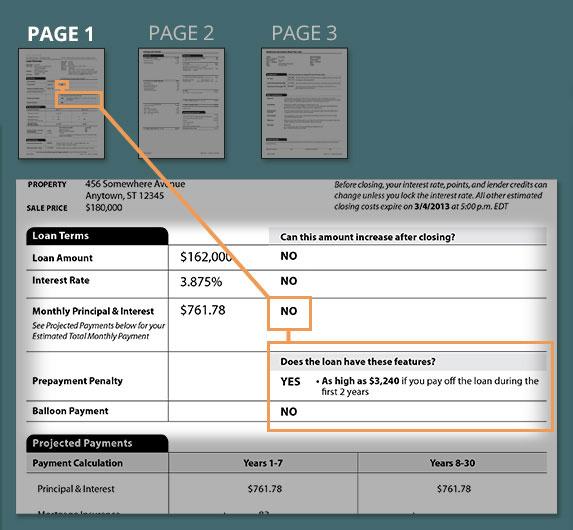

The loan's interest rate is listed toward the top of Page 1, in the "Loan Terms" section. The same section lists the loan amount and the monthly principal and interest.

If the mortgage offer is for a fixed-rate loan, the box to the right will say, "No," to indicate that the interest rate cannot increase after closing. But if the box says, "Yes," then the mortgage offer is for an adjustable-rate mortgage, or ARM.

- The annual percentage rate, or APR, is a calculation that results from adding closing costs to the total interest paid over the life of the loan.

- The total interest percentage, or TIP, represents the total interest paid over the life of the loan as a percentage of the loan amount. For example, if you borrowed $100,000 and then paid $82,000 interest over the next 30 years, the TIP would be 82%.

Another vital piece of information can be found at the top of Page 1: the loan term. The loan term is the number of years it will take to pay off the mortgage in equal monthly installments. The most common loan term is 30 years. The 15- and 20-year loan terms are popular, too.

How much will the closing costs be for this mortgage?

The estimated closing costs appear in 2 places on the Loan Estimate:

Detailed, itemized closing costs take up most of Page 2 in the "Loan Costs" and "Other Costs" sections.

Mortgage Fees

The "Loan Costs" section lists the fees associated with getting the mortgage. These fees include:

- Origination charges are lender charged costs. They may include charges such as points, underwriting or origination fee and tax service fee.

- Third-party services that you cannot shop for because the lender chooses the service provider. These services may include the appraisal, credit report, flood certification, flood monitoring, tax monitoring, tax status research and others.

- Third-party services that you can shop for. These services may include the survey, pest inspection, title search, title insurance and title agent or escrow agent.

The dollar figures in the Loan Estimate are supposed to be accurate, but lenders have leeway to underestimate some fees, while other fees have to be exactly on the money.

Homebuying Fees

While the "Loan Costs" section lists fees for getting the loan, the "Other Costs" section lists fees that, for the most part, have to do with buying or owning the home itself. These fees may include:

- Taxes and other government fees.

- Prepaid items. These are charges that are paid immediately to the recipients, such as the 1st payments for homeowners insurance, mortgage insurance and property taxes, plus several days' worth of mortgage interest.

- Escrow payments. These charges are deposited into your mortgage's escrow account for payment of future bills for homeowners insurance and property taxes.

- Other items, such as an optional owner's title insurance policy.

The total closing costs equal the total of all the above. But the closing costs do not equal "cash to close," or the amount of money that the borrower will have to take to the closing table.

How much cash to close?

How big a check will you have to write at the closing table? Or, in the lingo of the mortgage industry, what's the "cash to close?" The Loan Estimate lists the cash to close amount in 2 places:

At the bottom of Page 1, in the "Costs at Closing" section. This is the bottom-line number.

In the "Calculating Cash to Close" section on Page 2. This lists the various categories of fees, costs and credits that add up to the cash to close.

The categories listed in the "Calculating Cash to Close" section may include:

- The total closing costs.

- Minus any closing costs that are rolled into the loan amount.

- Plus the down payment (or, in a "cash-in refinance," money paid by the borrower to decrease the loan amount).

- Minus the deposit the homebuyer made when the offer was accepted.

- Minus seller credits.

- Plus or minus adjustments, refunds for overpayments and other credits.

Are any traps concealed in this mortgage?

Does the mortgage have any traps that could snare you? The Loan Estimate is designed to alert you to risky loan features.

Is the loan an ARM?

Most adjustable-rate mortgages are fine. Having an adjustable rate doesn't necessarily mean the loan is a trap. But if it is an adjustable-rate mortgage, or ARM, you need to know, because the monthly payments potentially could rise in the future.

If the loan is an ARM, the Loan Estimate tells you in 2 places:

Is there a prepayment penalty?

If the loan has a prepayment penalty, the word "yes" appears next to "Prepayment Penalty" in the "Loan Terms" section on Page 1 of the Loan Estimate. The maximum amount of the penalty is described, too.

A prepayment penalty is a fine levied on the borrower for paying off the loan early. It's a way to discourage borrowers from refinancing out of mortgages with high interest rates.

Prepayment penalties are rare now because regulators frown upon them. The penalties were a regular feature of subprime loans in the early 2000s. A study concluded that prepayment penalties increased foreclosure risk by 20%.

Have I locked the interest rate of the mortgage?

A rate lock guarantees that the lender will offer you a specific combination of interest rate, points and lender credit for the mortgage. A lock lasts for a limited time, and then it expires.

The Loan Estimate tells you whether the rate has been locked, and for how long. This information is found near the top of Page 1: